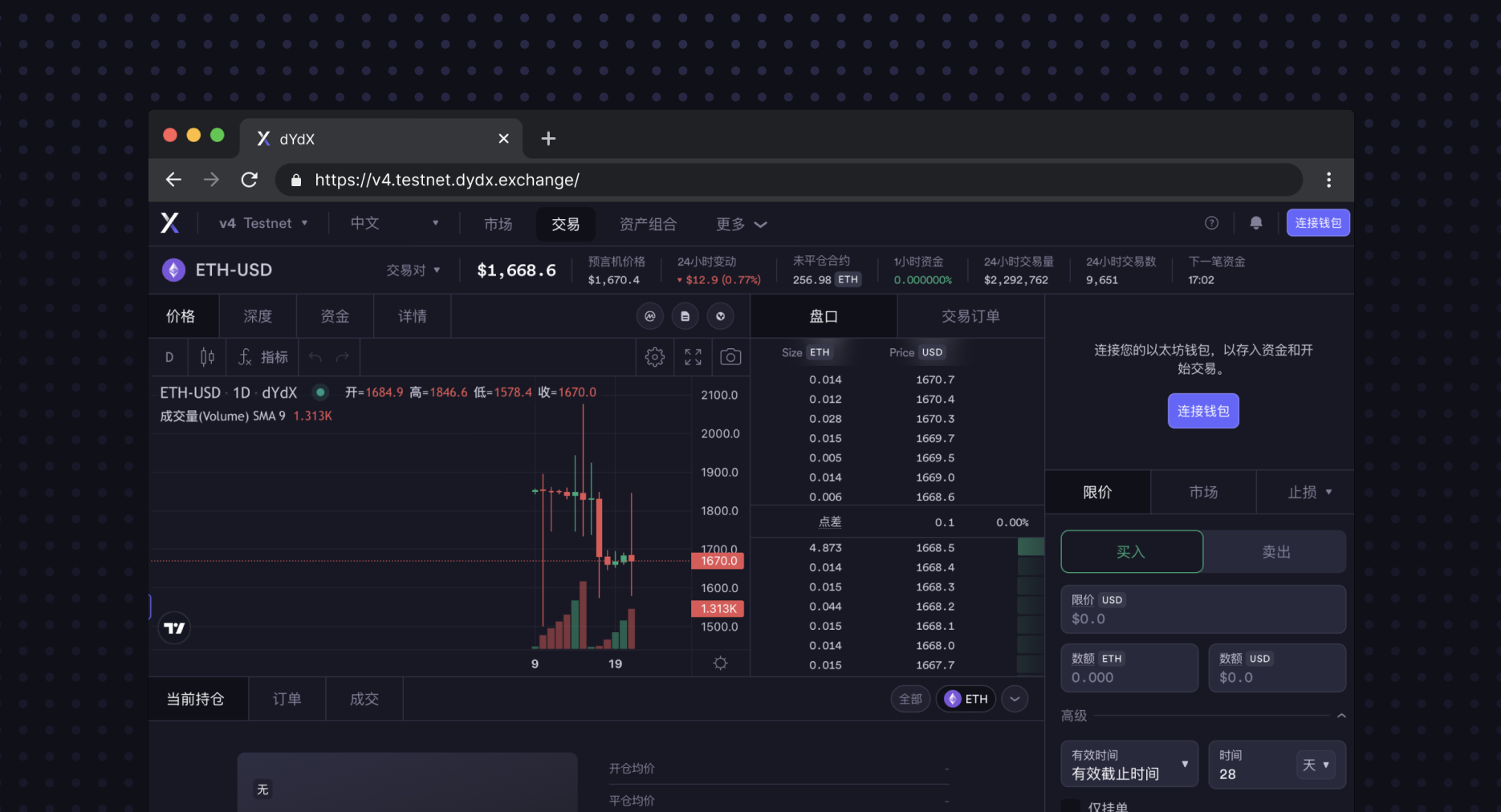

Online trading platform

When considering investment opportunities, particularly in mutual funds and hedge funds, one of the first hurdles an investor encounters is the minimum investment requirement unduh Exness. This threshold acts as a gatekeeper, determining who can and cannot participate in the investment. From the perspective of fund managers, minimum investment requirements are a practical necessity. They ensure that the fund has sufficient capital to operate efficiently and to justify the costs associated with managing the investments. For investors, these requirements can be both a barrier and a benchmark, signaling the level of commitment and financial capability needed to enter the market.

Remember, investing is a journey, and every investor’s path is unique. By taking the time to research and understand your options, you can navigate the market with confidence and work towards achieving your financial goals.

1. Diversification is Key: One of the fundamental principles of investing is diversification. By spreading your investments across various asset classes, sectors, and geographies, you can mitigate risk and enhance potential returns. For example, an investor who allocates funds to both a technology-focused ETF and a broad-market index fund is less exposed to sector-specific downturns.

User-friendly interface for traders

I’ve found Finviz to be an excellent tool for new investors. It’s free, quick, and simple to use. The platform packs a lot of useful data into an easy-to-understand format. With Finviz, you can easily research stocks, analyze market trends, and create custom watchlists. Let’s take a closer look at some of the key features that make Finviz such a valuable resource for new investors.

I’ve found Finviz to be an excellent tool for new investors. It’s free, quick, and simple to use. The platform packs a lot of useful data into an easy-to-understand format. With Finviz, you can easily research stocks, analyze market trends, and create custom watchlists. Let’s take a closer look at some of the key features that make Finviz such a valuable resource for new investors.

TrendSpider has an easy-to-use backtesting tool. I can test my trading ideas with just a few clicks, and the platform displays buy and sell signals directly on the chart. This visual approach makes it easier for me to see what’s working and what isn’t.

I’ve compiled a list of top trading platforms for beginners. TradingView stands out as the best overall option. Meanwhile, TrendSpider offers automated chart analysis, while Finviz provides free stock screening. Lastly, TC2000 is user-friendly with great educational resources. These platforms cater to new traders with helpful tools and features.

Finviz’s heat maps are a notable feature. They present the entire US stock market on a single screen. They allow a quick overview of stock performance, and by hovering over a stock symbol, you can access insights like current performance, competitors, and a popup chart for deeper analysis.

One of the most impressive features is the vast market coverage. TradingView gives you access to nearly every stock market worldwide, along with ETFs, futures, forex, and bonds. All this comes at no extra cost, making it incredibly valuable for new traders.

Investment portfolio management

2. Figuring out how much help you want: Some investors may prefer to choose all their investments themselves; others would be more than happy to let a portfolio manager take over. If you can’t decide, a robo-advisor might be an ideal solution, as these services are very low cost. Portfolio managers will charge more than a robo-advisor, but they typically offer a customized portfolio and other services beyond portfolio management, such as financial planning.

Additionally, enhance your risk management skills with courses like Risk Management Professional (PMI-RMP) and Management of Risk (MoR) Certification, essential for mitigating risks within portfolios.

Portfolio management requires the ability to weigh the strengths and weaknesses, opportunities and threats of a spectrum of investments. The choices involve trade-offs, from debt versus equity to domestic versus international and growth versus safety.

An aggressive portfolio takes on substantial risk in pursuit of maximum returns. It heavily emphasises growth-oriented equities to drive higher potential capital appreciation over the long run. An aggressive portfolio generally holds 80-100% in stocks and little to no bonds or cash. The stock allocation focuses on segments with higher volatility like small-caps, specific sectors, or emerging markets.

Online trading platform

The SIPC doesn’t cover risks like unauthorized trading activity, but most of the best brokerage accounts have fraud protection that covers you if your account is hacked. The trick is letting your brokerage know ASAP.

Why it made our list: Fidelity has earned its place as one of the gold standards in the brokerage world, and for good reason. With decades of experience, millions of customers, and an undeniable reputation for reliability, it’s easy to see why Fidelity is trusted by investors.

The Forbes Advisor Investing team is committed to providing unbiased rankings and information with complete editorial independence. We use product data, strategic methodologies, and expert insights to inform our content and guide you in making the best decisions for you.

We gather and analyze consumer sentiment from a range of sources to create the Consumer Sentiment Index to determine customer satisfaction levels for each feature outlined below. This data is designed to give you an idea of real consumer experience of the services and product we review. This data is currently separate from our overall rating out of 5

Still, the boundary between the two categories of brokers is more and more blurry. Online brokers increasingly offer more services, while full-service brokers increasingly cut costs. In fact, many investors would be hard pressed to explain why some online brokers–especially the larger ones–should not be thought of as full-service firms.